Business Insurance in and around Bellport

Get your Bellport business covered, right here!

This small business insurance is not risky

Help Protect Your Business With State Farm.

When you're a business owner, there's so much to focus on. You're not alone. State Farm agent Greg Mehrhoff is a business owner, too. Let Greg Mehrhoff help you make sure that your business is properly protected. You won't regret it!

Get your Bellport business covered, right here!

This small business insurance is not risky

Protect Your Business With State Farm

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a real estate agent or a dentist or you own a beauty salon or a refreshment stand. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Greg Mehrhoff. Greg Mehrhoff is the person who can relate to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to understand your small business insurance options

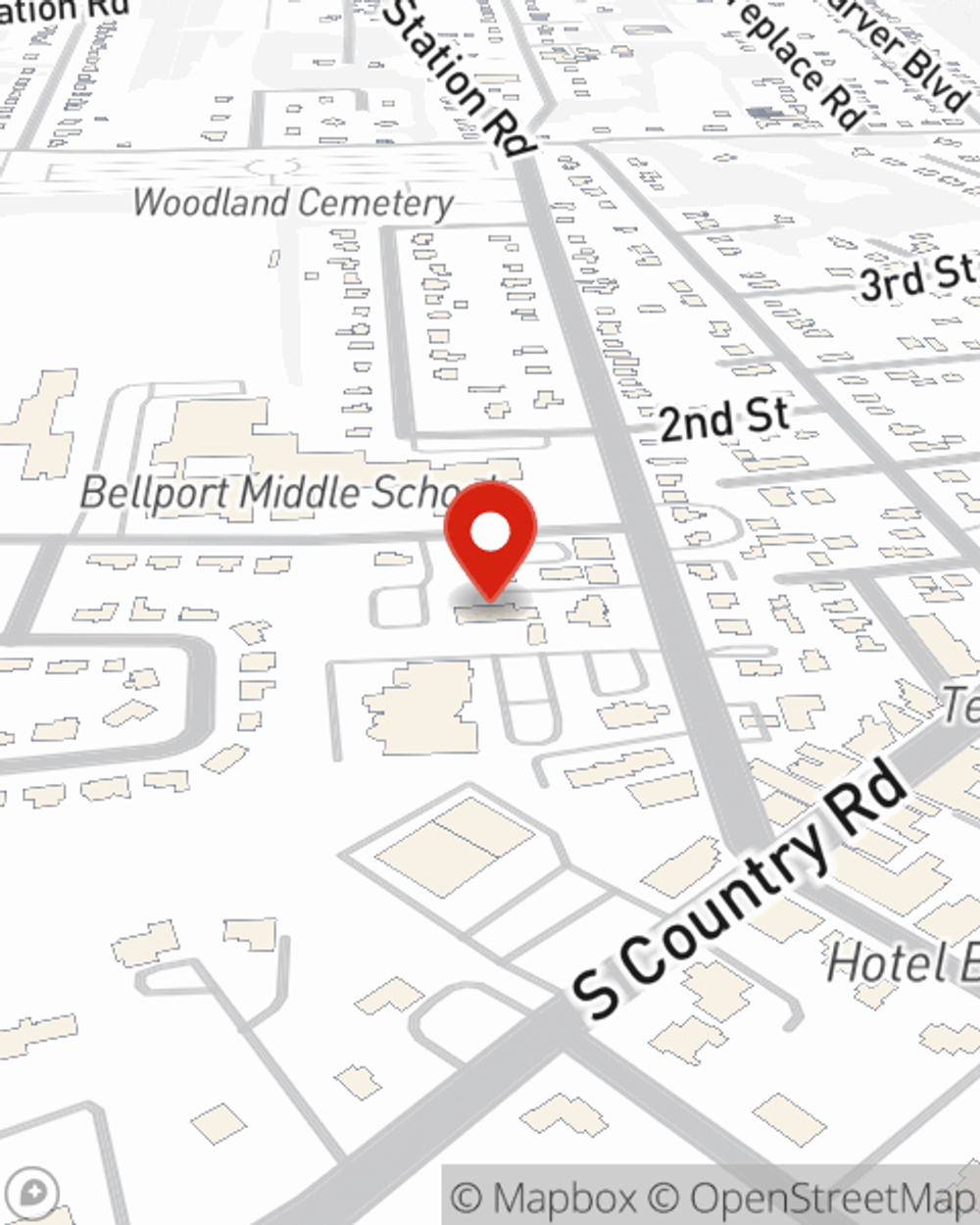

At State Farm agent Greg Mehrhoff's office, it's our business to help insure yours. Visit our excellent team to get started today!

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Greg Mehrhoff

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.